Mission Critical: How Graphene is Shaping the Future of Technology

Issue 1 | January 5, 2026

Welcome to the first issue of The Graphene Frontier, a publication providing independent analysis of graphene and advanced materials. This edition examines applications transforming defense, aerospace, and energy systems, and considers the strategic imperatives shaping domestic supply chain development.

Editor’s Note: Strategic Momentum in Advanced Materials

Graphene has progressed from laboratory research to a material of strategic importance. Its combination of high conductivity, exceptional strength, and thermal performance addresses longstanding challenges in energy systems, electronics cooling, and nuclear power generation.

This issue highlights three converging trends:

- Advances in energy storage – including next-generation batteries and ultracapacitors.

- Thermal management innovations – critical for high-power and hypersonic systems.

- Graphene applications in nuclear technology – enhancing safety and efficiency.

We also consider the geopolitical dimension, particularly U.S. efforts to reduce dependence on foreign graphite supply. For investors, defense planners, and industrial decision-makers, 2026 represents an inflection point where technical maturity, policy priorities, and market opportunity intersect.

Key figures:

- 30%+ – projected industry CAGR through 2030

- 80% – Chinese share of global graphite production

- $2B+ – projected battery market value by 2027

Energy Storage: Batteries and Ultracapacitors

Graphene-enhanced energy storage systems achieved notable performance improvements in 2025. Graphene-integrated batteries demonstrated 30–50% higher energy density and faster charging relative to conventional lithium-ion systems. Ultracapacitors incorporating graphene offered 5–10x extended cycle life and substantially higher power density, supporting applications such as pulsed energy devices, electromagnetic launchers, and grid stabilization.

Applications in context:

- Enhanced batteries: longer operational duration for UAVs and portable power systems

- Ultracapacitors: rapid power delivery for high-demand military and industrial applications

- Defense relevance: reliable operation in austere environments with constrained logistics

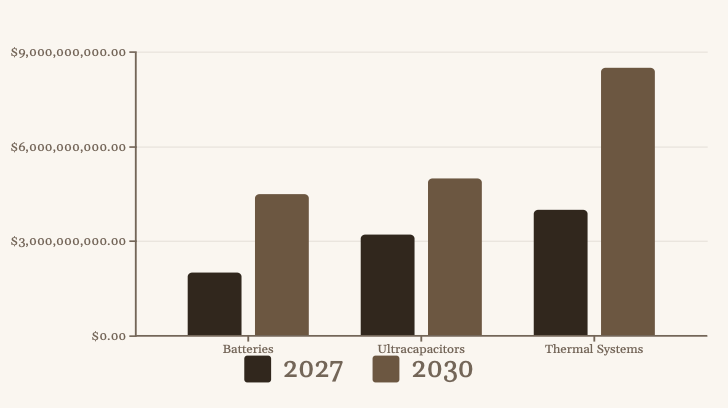

Market outlook:

- Graphene battery segment projected at $2B by 2027 (CAGR 35%)

- Ultracapacitors projected at $5B by 2030 (CAGR 25%)

- Domestic production capacity is increasing, supported by government initiatives and defense procurement programs

Thermal Management: Critical Cooling Solutions

Graphene’s high thermal conductivity (~5,000 W/mK) enables improved heat management in electronics and high-power systems. As platforms increase in complexity and power density, thermal constraints increasingly limit performance and reliability.

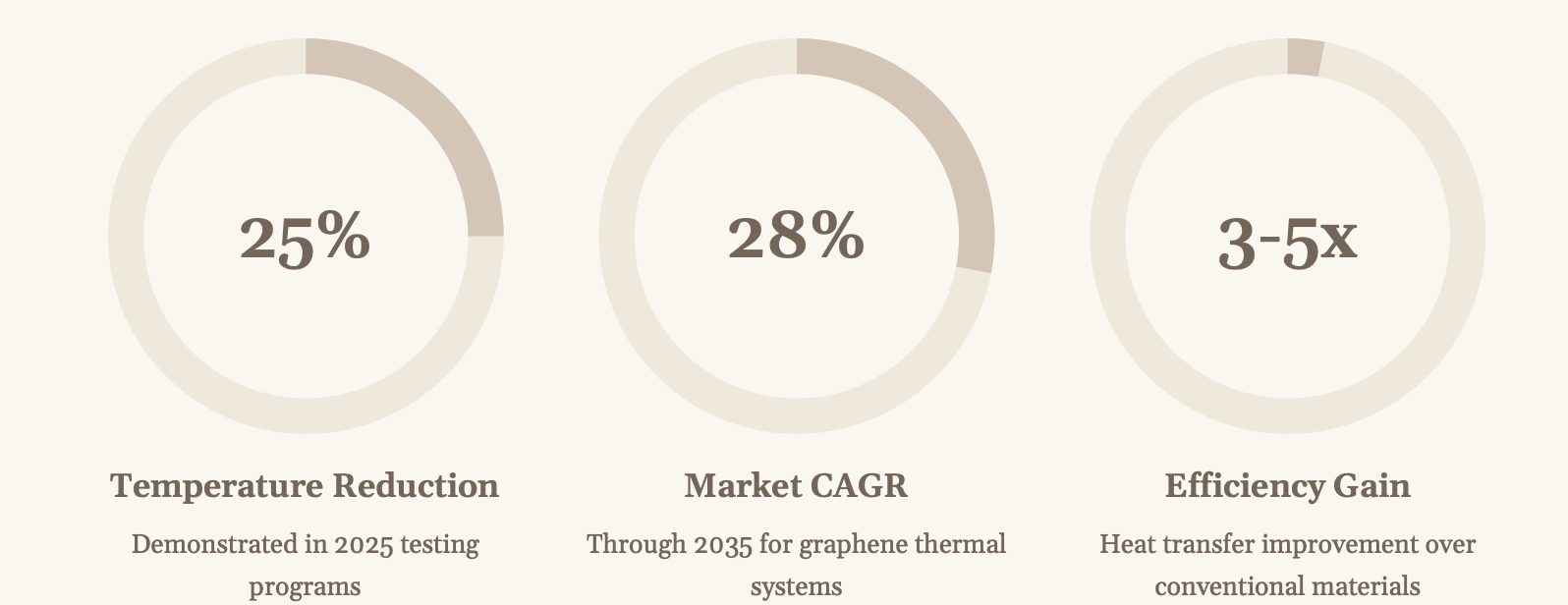

Performance highlights:

- 3–5x more efficient heat transfer than traditional materials

- 25% temperature reduction observed in high-power electronics tests

- Extended component lifespan and improved operational duty cycles

Market context:

- Current defense thermal management market: $4B annually

- Projected expansion: $15B by 2035 (28% CAGR)

- Government-supported domestic production is reshaping supply chains

Nuclear Applications: Safety and Efficiency

Graphene’s chemical stability and radiation resistance make it suitable for next-generation nuclear systems, particularly Small Modular Reactors (SMRs).

Applications:

- Protective coatings for reactor components, extending operational life

- Enhanced thermal conductivity in fuel assemblies, improving efficiency and reducing waste by ~20%

- SMR integration: smaller footprints with improved passive safety margins

Market potential:

- Graphene-enabled nuclear applications projected to add $10B by 2030

- Long development and certification timelines create substantial barriers to entry but durable competitive advantages

Geopolitical Context: Reducing Strategic Dependence

China controls roughly 80% of global graphite production, the primary feedstock for graphene. U.S. policy measures in 2025—including tariffs on graphite anodes and investments under the Defense Production Act—aim to establish secure domestic supply chains.

Implications for investors:

- Domestic production reduces reliance on foreign suppliers

- Government-backed initiatives provide revenue visibility and risk mitigation

- Early participation in qualified supply chains offers strategic advantage as procurement priorities shift

2026 Outlook: Positioning and Opportunity

Graphene is approaching a point where technology, policy, and market conditions converge. Key trends include:

- Transition from research to production-scale applications across energy, thermal, and nuclear systems

- Alignment of domestic supply chain initiatives with national security priorities

- Projected 30%+ CAGR through 2030, with multiple entry points for investors across the value chain

For defense and aerospace decision-makers, graphene-enabled systems offer measurable operational advantages. For institutional investors, the combination of technological maturity, policy support, and supply chain restructuring provides multiple avenues for long-term opportunity.

As 2026 progresses, graphene’s evolution from experimental material to a mission-critical enabler is accelerating, offering a foundation for informed decision-making and strategic investment.